MoneyWorks Manual

Submitting data to GST InvoiceNow

Periodically you need to transmit data that has not been eInvoiced to IRAS. This includes direct sales to consumers, "petty cash" purchases and any purchase and sales invoices that have not been e-Invoiced. How often you submit this is up to you (IRAS suggest weekly), but should be done before submitting your GST.

Sending this additional data is done through the InvoiceNow window (shown above).

To send new data to IRAS:

- Click the Send to IRAS button

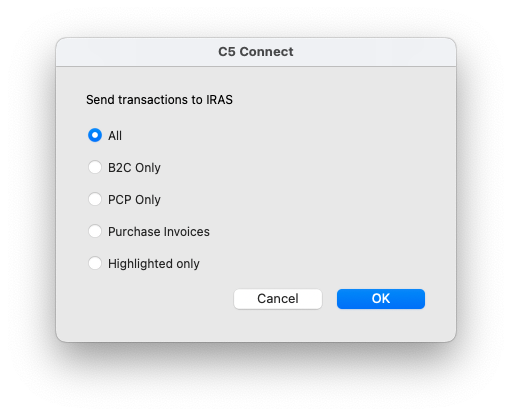

You will be prompted to send all new relevant data, or just selected data.

- Choose what to send and click OK

Choose the type of data you wish to submit by turning the checkbox next to each type.

The data sent is based on transactions posted since the last time you submitted that type of data. The time of the last submission for each transaction type is shown.

Note: The submission may take some time if there is a lot of data.

Aggregated Data

This is data that is aggregated and sent as a summary. It consists of transactions that cannot been sent as eInvoices. For example, Business to Consumer (B2C) "cash" sales cannot be sent by eInvoice as consumers will not have access to eInvoicing.

B2C transactions: These are straight "cash" receipts (i.e. not receipts against invoices).

PCP transactions: Petty Cash Purchases (PCP) are direct "cash" payments in MoneyWorks, i.e. they are not invoice payments.

Non eINvoiced Transactions

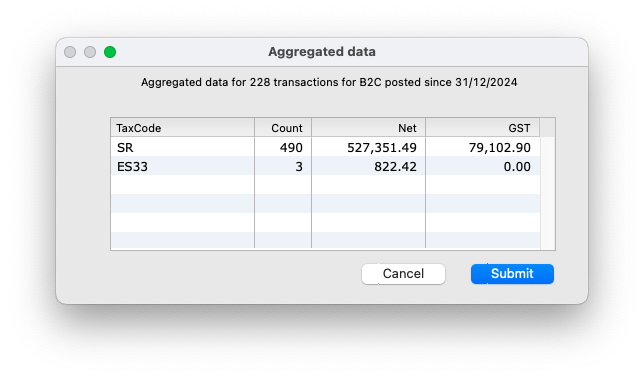

These are invoice transactions that have not been eInvoiced. Unlike the summary data sent above, each individual invoice is submitted to IRAS separately. Before this, a summary is shown of the GST amounts before the submission commences.

Purchase Invoices: These are purchase invoices that have been directly entered and not received via eInvoicing.

Sales Invoices: These are sales invoices that have not been eInvoiced. This includes ones which can't be eInvoiced because there is no UEN recorded in the customers eInvoice ID field, and optionally, any that can be eInvoiced but haven't yet been sent. Note: Choosing to send the latter will eInvoice them to the customer as well as to IRAS.

Note that a summary of the aggregated GST is shown for each of the types of submission selected. If you click Cancel on this summary window the data will not be sent, but the candidate transactions will be displayed in the transaction list window so you can easily review them.