MoneyWorks Manual

E-Invoice Settings

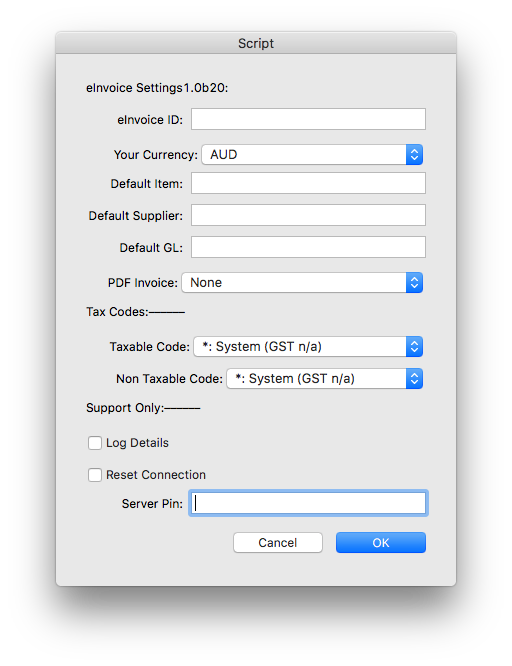

Before you use e-invoicing, you need to set up the e-invoicing settings and defaults in MoneyWorks.

- Choose Command>E-Invoice Settings

The MoneyWorks e-invoice Settings window will be displayed.

- Enter your e-invoice ID

This will be your ABN, NZBN, UEN or VAT Number, depending on country. Note that this must be same as the one entered in the e-invoice Sign Up page

- Specify your default currency

Invoices received will be assumed to be in this currency

- Enter a default item, supplier code and GL Code

If MoneyWorks cannot identify the supplier or item on a supplier invoice, it will substitute these (you will need to check and correct the invoice).

- If you want to include a pdf with the e-invoice, select the invoice form to use from the PDF Invoice pop-up

Leave this at None if you do not wish to include a pdf.

- Select the correct tax codes to use for transaction lines on e-invoices that have GST/VAT and those that don't

MoneyWorks will assign those codes to the lines but will not change the GST amount on the imported invoice.

Leave the Support settings untouched unless requested by MoneyWorks support.