MoneyWorks Manual

Receive Refund from Creditor

The Receive Refund from Creditor1 command is the complement of the Return Refund to Debtor command (and is not available in MoneyWorks Cashbook). Use this command where you have overpaid a creditor (supplier) and are processing the refund; if the creditor invoiced you incorrectly and is now making good; or if the amount that you hand-wrote a cheque for was in excess of the amount that you entered for the payment in MoneyWorks.

You will need a credit note (i.e. negative Purchase Invoice) for the value of the cheque that you have received from the creditor—if you have deliberately overpaid (see Overpaying a Creditor), MoneyWorks will have created this for you, otherwise you will need to create it yourself. If the creditor has sent you a cheque with an incorrect amount (not enough, for example), you should enter a credit note for the amount that they have sent you, and another for the amount that they still owe you—this is because MoneyWorks will only accept complete payments on creditor credit notes.

To receive a cheque from a creditor:

- Choose Command>Adjustments>Receive Refund from Creditor

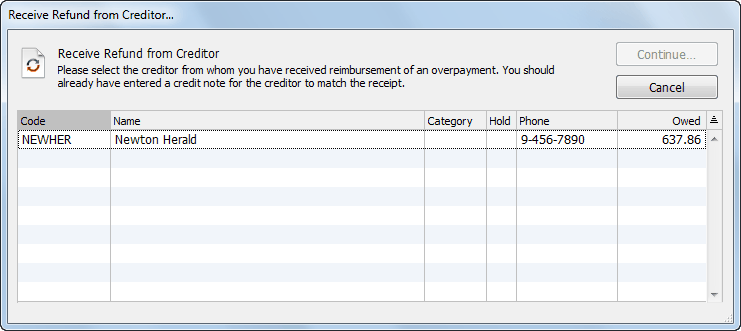

A list of creditors who have outstanding credit notes is displayed.

Note that the amount shown is their total balance, not the credit amount.

- Highlight the creditor from whom you received the cheque and click Continue

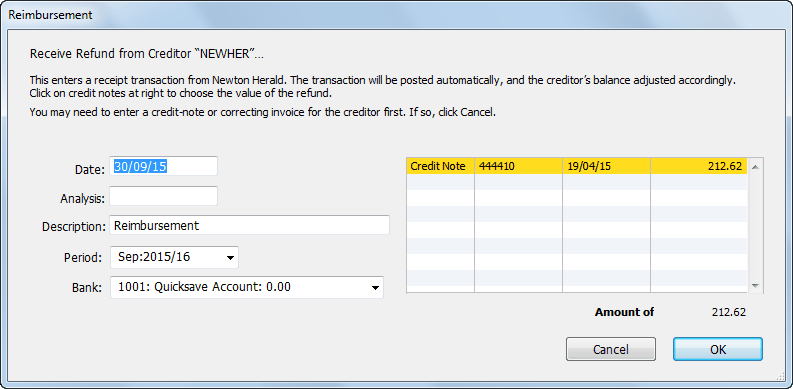

The Receive Refund from Creditor dialog box is displayed.

If no credit note exists for the creditor, an alert is given. You must enter the credit note before you choose Receive Refund from Creditor.

Any outstanding credit notes for the creditor will be displayed and highlighted in the list on the right-hand side of the dialog box.

- If the cheque that you have received does not correspond to all the credit notes in the list, click on any credit notes in the list that you do not want to include

The items that you click on will be unhighlighted and the cheque amount will reduce accordingly. You can click on an item again to rehighlight it.

If the credit notes in the list do not correspond to the amount of the cheque, you will need to enter a correction (either another credit note, or a normal positive invoice).

- Choose the bank, date, period and analysis for the Receipt

- Click OK

The Cash Receipt will be created and posted. This will debit the nominated bank account and credit the creditor’s Accounts Payable control account.

The GST component of this cheque will correspond to that specified in the credit note.

1 This was Receive Cheque from Creditor in MoneyWorks 6 and earlier ↩