MoneyWorks Manual

Opening a New Financial Year

Many accounting systems require special procedures to be carried out to “roll over” into a new financial year. In MoneyWorks, all you have to do is provide a name for the new financial year—MoneyWorks does everything else for you.

You can open a new financial year even if you have not completed your accounts for the previous financial year. MoneyWorks will simply carry forward anything that is posted in the previous year.

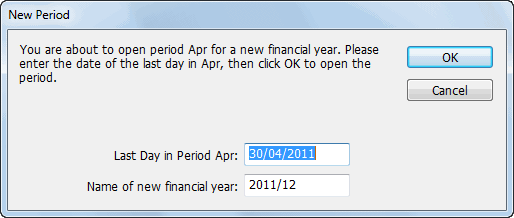

MoneyWorks starts a new financial year if you open a new period when the current period is the last one for the current financial year. MoneyWorks will beep three times and display a different New Period dialog.

Note: The Last day in Period is the date of the end of the first period in the financial year, not the end of the financial year itself.

What Happens When I Start a New Year? When MoneyWorks opens the first period of a new financial year, it calculates the difference between the closing balances of the income accounts and the expense accounts. This difference is the profit (or loss) for the year. Instead of carrying forward the closing balances for income and expense accounts into the new year, MoneyWorks zeros the opening balances for these accounts and adds the profit to the Profit and Loss (PL) account(s).

What Do I Have To Do? If you are running a debtors or creditors ledger, it is a good idea to print out the Payables and/or Receivables lists as they stand at the end of the financial year. This will allow you to more easily reconcile your closing accounts receivable and accounts payable accounts to the actual outstanding invoices1.

To do this, simply select the appropriate tab in the View by Status view of the transactions list (such as Payable or Receivable) and choose Print from the File menu. Alternatively you could print out the Aged Debtors and Aged Creditors reports.

You should check with your accountants to find out what information they will require They may require a stock take as at the end of year, a list of outstanding debtors and creditors and so forth.

Once you have processed all your invoices and payments for the old financial year, it would be a good idea to lock all the periods in it. This will stop you inadvertently entering transactions into the old financial year. You will unlock it when your final results are available from your accountant, as you will need to enter some adjusting transactions (such as depreciation).

1 You can also use the Aged Receivables/Payables Report to do this at a later date if you don’t do it at the end of the period. ↩