MoneyWorks Manual

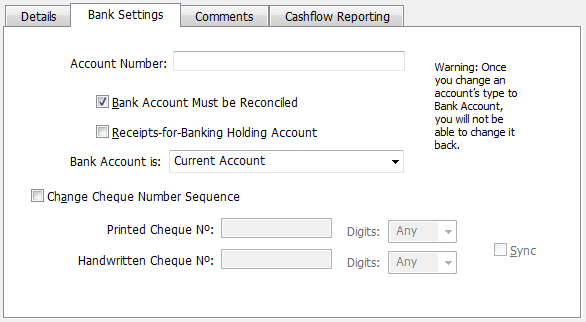

Bank Settings

The options for bank accounts are accessed under the Bank Settings tab.

These options are only available for bank accounts.

Account Number: This is your bank account number (supplied from your bank). It is used in direct payment of creditors —see Electronic Payments, and needs to be specified in the correct format1.

In New Zealand it should be entered in the form "00-0000-0000000-000”, where the first six digits are your bank and branch codes, the next seven (or eight) your account code, and the last three the account suffix.

In Australia it is entered in the form “000-000-00000000”, where the first six digits are your BSB number and the last eight your account code.

If the format of your bank account number differs you should still use the format above — MoneyWorks will adjust the bank account to meet the requirements of different on-line banking systems. For example, if you have a six digit account code 123456, it should be recorded as 0123456, with left padding of zeros to bring it up to the required length.

In locations outside of New Zealand and Australia, you should enter the bank account number in the form provided by the bank — MoneyWorks will not apply any formatting rules.

Bank Account Must be Reconciled: Set this option if you want the bank account to be reconciled (for a discussion on this see Bank Reconciliation). If this option is set, posted transactions involving the bank account will not be able to purged —see Purging a Period unless they are reconciled. It is recommended that this option is set for all real bank accounts.

Receipts-for-Banking Holding Account: Set this option if the bank account is not a “real” bank account, but is a temporary one for holding money until it can be banked. For example, it may represent the takings in the cash register, or a pile of cheques and cash that have been received in the mail and are waiting to be banked. Transactions held in this sort of account are transferred to a “real” bank account by the Banking command. These bank accounts do not need to be reconciled.

Bank Account is: Set this to determine whether the bank account is a current, term, credit card or term loan account, affecting where it appears on the standard balance sheets.

Change Cheque Number Sequence: Turning this option on if you need to change the cheque sequence number for the bank account (each bank account has its own sequence number). Two sequence numbers are available:

Printed Cheque: For pre-printed cheque forms. This number sequence is used in the Batch Creditor Payments facility.

Handwritten Cheque: This sequence number is used in “manual” cheques, whenever a Payment transaction is printed.

The sequence numbers are automatically padded to the number of digits specified in the digits pop-up menu.

If you do not have pre-printed cheques, set the Sync option — this will give you a single set of sequence numbers.

1 The format varies from country to country — when you tab into the field a tool-tip is displayed showing the country format (if any). ↩